GSW // FINANCING HIGH PERFORMANCE BUILDINGS

A guide to optimizing energy performance across the multifamily building cycle

Established in 1974, The Community Preservation Corporation (CPC) is a nonprofit affordable housing and community revitalization finance company that believes housing is central to transforming underserved neighborhoods into thriving and vibrant communities.

CPC’s Sustainability Platform was formed in 2008 to carry out the organization’s energy efficiency and de-carbonization initiatives. Since launching the Sustainability Platform, CPC has financed hundreds of energy efficient, multifamily projects and is committed to supporting the development of high-performance affordable housing. CPC is one of the first real estate nonprofits in the United States to achieve carbon neutral operations. In February 2020, CPC – carrying a AA- Issuer Credit Rating from S&P – issued its inaugural public offering of Sustainability Bonds, one of the largest bond sales completed by a Community Development Financial Institution (CDFI). CPC will deploy the capital raised in furtherance of its nonprofit mission of investing in affordable and sustainable multifamily housing.

During the creation of this guide, COVID-19 rapidly became a global health crisis, drastically affecting the health, safety, and stability of communities worldwide. Underserved communities, particularly those of color, often suffer far deeper impacts during times of crisis due to pre-existing social and economic disparities.

As the COVID-19 outbreak continues, communities of color are experiencing significantly higher rates of infection, hospitalization, and mortality.

The disparities that have deepened the pandemic’s impact, such as a lack of access to affordable housing, man made environmental hazards (proximity to transit depots and highways) that lead to a prevalence of preexisting medical conditions ( increased asthma rates), and lack of economic opportunity are also contributors to another crisis disproportionally affecting underserved neighborhoods — climate change.

We invite you to join us in exploring how we can use the lessons learned through the COVID-19 recovery process to simultaneously advance the climate agenda. Our initial thoughts:

- Affordable, resilient housing is essential to mitigating the impacts of health, economic, and environmental crises.

- The impacts of a crisis are not felt equally – programs that support low- and middle-income families and address racial inequality must be part of any long-term solution.

- Economic recovery programs should focus on moving toward clean energy by supporting innovation and workforce development that accelerate the low-carbon transition.

- A transition toward a carbon neutral economy and building stock provides a significant opportunity for upward mobility. Communities that have historically been marginalized should be prioritized as part of any transition.

UNCOMMON EXPERTISE. UNMATCHED IMPACT.

INTRODUCTION

In 2017, with the help of our partners in the affordable housing ecosystem, CPC developed the Underwriting Efficiency Handbook (the Handbook) as a free resource to support lenders in their efforts to incorporate energy efficiency into first mortgage financing. The Handbook outlines the benefits for both lenders and building owners of implementing different levels

of energy efficiency and water conservation measures, including enhanced financial stability, tenant satisfaction, and improved property condition. The Handbook successfully advanced the conversation around incorporating savings from energy efficiency improvements into the underwriting process, helping to improve the financial and physical health of the buildings and communities in which we live and work.

GUIDE OVERVIEW

Designing, financing, and constructing multifamily buildings to be highly energy efficient represents an enormous opportunity to improve the quality and resilience of the building stock, lower operating expenses, and reduce greenhouse gas emissions, while providing long-term value to building owners, tenants, and municipalities.

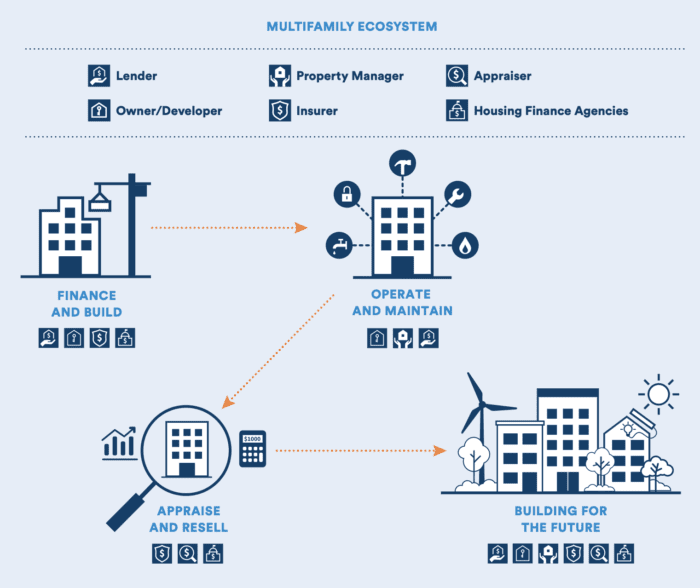

In order to distinguish the long-term value of highly energy efficient multifamily housing, we have created this guide — Financing High-Performance — as a supplement to our original Handbook. This guide is designed for multiple stakeholders within the multifamily ecosystem who may interact or overlap throughout the building lifecycle including lenders, owners and developers, appraisers, insurers, policy makers, as well as city, state, and municipal housing finance agencies. Our goal is that this guide serves as a helpful resource for all stakeholders when confronted with high-performance projects that do not conform to ‘conventional’ practices. By better understanding how high-performance projects operate in the real world, and the non-energy benefits that add value to the physical asset and the lives of the tenants and communities the projects serve, we hope to help overcome incremental first cost barriers that prevent wider adoption of high-performance design principles in the affordable housing sector.

FOCUS ON NEW CONSTRUCTION

We recognize there is still a gap to be addressed, specifically regarding the challenges of high-performance retrofits. Due to the complexity of retrofits and the lack of supportable data at this time, we are focusing on new construction in this guide, and will explore opportunities to cover retrofitting to high-performance design standards in a future supplement.

We will be talking about: what is a high performance building, the growing interest in high performance buildings, finance+build, operate + maintain, appraise +resell and building for the future.

LIFECYCLE OF THE BUILDING

Lenders, owners and developers, appraisers, insurers, and city, state, and municipal housing finance agencies – these multifamily housing stakeholders have an important role to play in the adoption of high-performance principles.

Taking a look at the lifecycle of a multifamily building, there are numerous stakeholders that affect how a building is financed, built, operated and maintained, and appraised. By examining how each stakeholder within this ecosystem influences the quality and condition of the housing stock, we demonstrate how early design choices, and the building

principles incorporated, affect financing decisions, operating and commissioning costs, and the overall long-term value

of the property given a changing regulatory and policy environment as many cities and states transition to a low- carbon economy.

WHAT IS A HIGH-PERFORMANCE BUILDING? – A PRIMER

Before we explore the advantages of adopting these principles, we must first define “high-performance.”

BUILDING FOR THE FUTURE

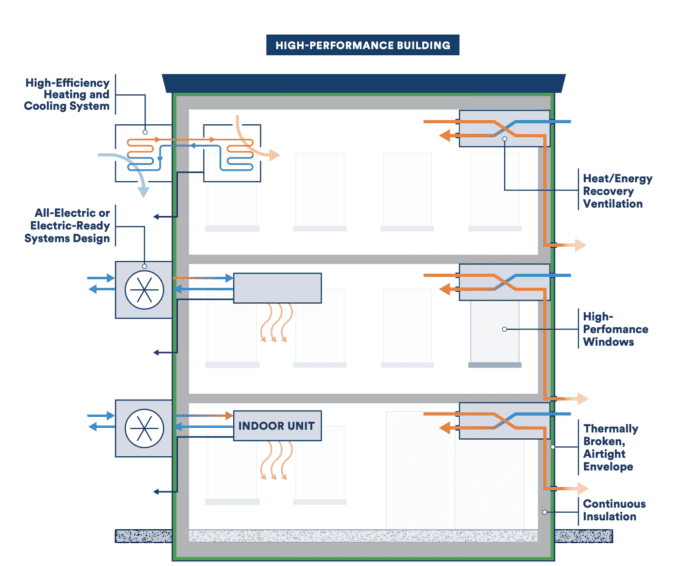

High-performance buildings utilize a set of key design principles that optimize all major building systems to achieve superior energy efficiency, durability, and comfort. These buildings not only reduce overall operational energy and water consumption, they also cut utility costs for building owners and tenants, helping to improve cash flow and preserve long-term affordability.

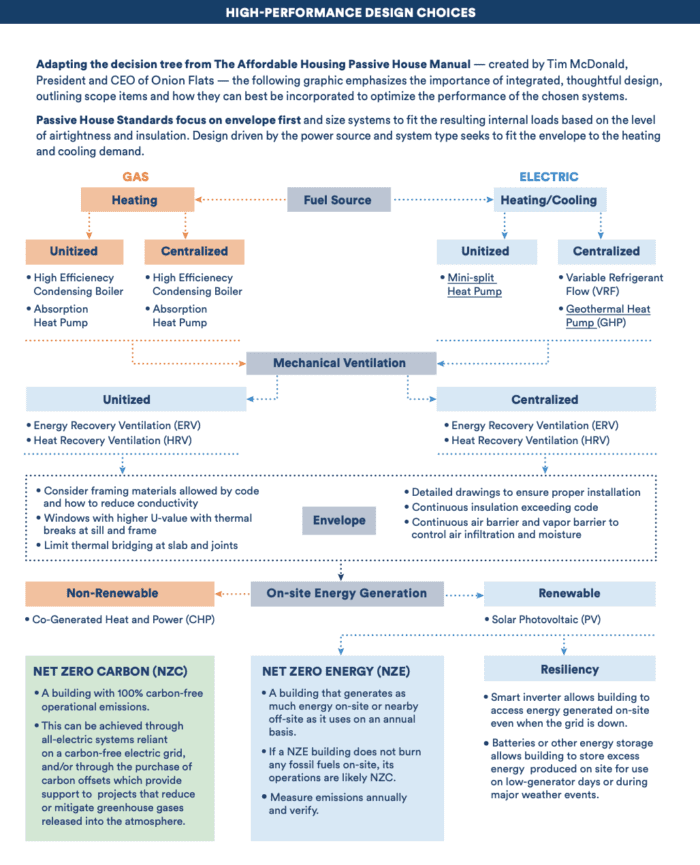

These principles are derived from performance-based design standards and certification programs and include:

- Highly insulated, thermally broken, airtight envelope

- Continuous fresh air intake and balanced ventilation with heat recovery / energy recovery

- High-efficiency heating and cooling systems appropriately sized to the conditioned space

- Prioritization of electric-powered heating ventilation and air conditioning (HVAC) and domestic hot water (DHW) systems, or electric- ready systems design

- High U-value windows (double- or triple-pane)

- Potential integration of on-site renewables

Combined with careful installation, initial and ongoing commissioning, and systems monitoring, these buildings reach well beyond standard code-built buildings as well as most points-based certification criteria to optimize performance.

High-performance buildings improve the efficiency of HVAC systems, enhance durability and resiliency,

and optimize comfort for tenants. Through intentional design and careful installation, a continuous air-barrier and insulation serve to reduce air, moisture, and pest infiltration as well as decrease external noises and smells. Improvements to the building envelope, energy efficient windows, strategic use of solar gain and shading, and limited thermal bridges better equip buildings to sustain comfortable indoor temperatures. As a result of the specialized mechanical ventilation systems, high- performance buildings have the ability to improve indoor air quality, potentially ameliorating the health and well- being of tenants.

Passive House,1 Net Zero Energy (NZE) and Net Zero Carbon (NZC) are examples of high-performance building types and show how design and energy choices can improve comfort, resiliency, and operating expenses.

In NZE buildings, the energy use is equal to or less than the energy supplied to the building by renewable sources, either on-site or off-site, on an annual basis.2 NZE buildings can further achieve energy independence with the addition of smart inverters and/or on-site energy storage to enable systems to run even when the grid is down. NZC buildings go one step further in ensuring all energy used by the building comes only from renewable sources; these buildings use only carbon-free electricity to supply heating, cooling, domestic hot water, ventilation, and lighting.

INDUSTRY EVOLUTION AND THE GROWING INTEREST IN HIGH-PERFORMANCE BUILDINGS

The transition to a low-carbon economy is creating a regulatory and policy environment in which high-performance is the new baseline.

GROWING PRESSURE TO REDUCE RELIANCE ON FOSSIL FUELS

Buildings in the residential and commercial sectors account for nearly 40 percent of the energy used in the United States.3 Likewise, these types of buildings account for as much as 70 percent of carbon emissions in cities, drawing critical awareness to the importance of better building performance.

The growing pressure to reduce energy consumption, minimize our reliance on fossil fuels, and make buildings more resilient to extreme weather-related events is spurring an increase in demand for energy efficient, all-electric buildings. States across the country and nations worldwide are rapidly adopting renewable energy and carbon neutral goals. Utilities are increasingly committed to transitioning to carbon-free electricity production. Energy codes and green building standards are evolving and transforming the way we approach design and construction.

Ensuring that the new multifamily building stock is significantly more energy efficient through high- performance design measures offers cities and states an opportunity to make meaningful reductions in their energy use and greenhouse gas (GHG) emissions, safeguarding quality, affordable housing for low- and middle-income communities, and resilient cities for future generations.

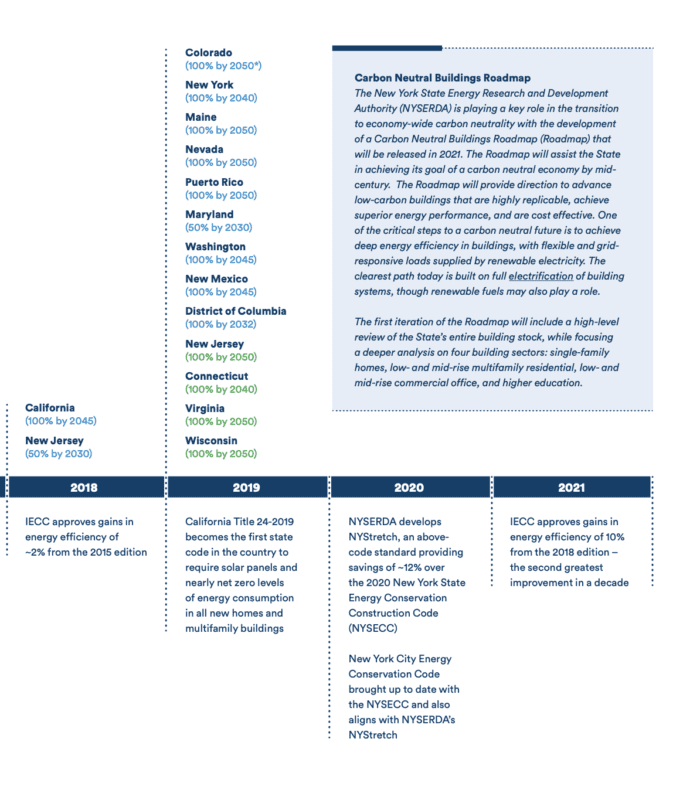

U.S. CITIES AND STATES RAPIDLY ADOPTING LOW CARBON GOALS

A number of cities and states have set ambitious clean energy targets, requiring a certain amount of their energy be produced from renewable, carbon-free sources. In 2019, states made more clean energy pledges than had ever been committed to before, with many aiming to become carbon neutral in the coming decades. As noted by the World Resources Institute (WRI), constituents were at the root of the groundswell; “public concern about the current and future effects of climate change drove much of this action, making goal-setting a legislative priority for many governors.”

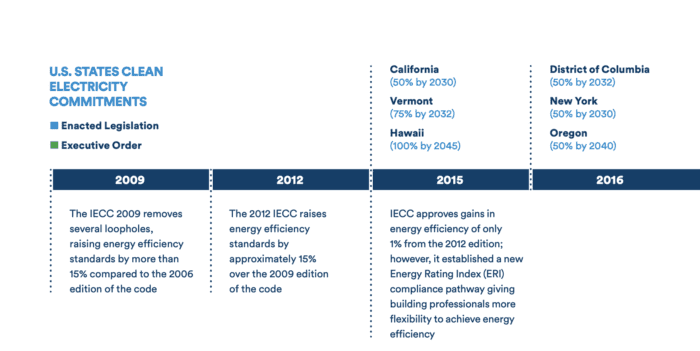

CHANGES IN CODE

Because the energy demand of buildings is so large, designing and constructing energy efficient buildings is a “cost-effective way for cities and local governments to cut carbon emissions, eliminate energy waste, improve comfort and health for building occupants, and increase housing affordability by reducing the ongoing energy burden for owners and renters.”

The United States’ model energy code — the International Energy Conservation Code (IECC) — establishes minimum efficiency standards for new construction (walls, floors, ceilings, lighting, windows, doors, duct leakage, and air leakage). Every three years, the IECC is updated to incorporate new building technologies and practices. Improvements in energy efficiency have led to emissions reductions in the residential and commercial sectors by 17 percent and 11 percent, respectively, since 2005, largely a result of changes in energy and building codes.

As the energy code evolves, the incremental cost of building to high-efficiency standards will come down. In 2019, we saw a number of jurisdictions leapfrogging the model energy code creating their own “stretch codes” and advancing local regulations beyond the minimum standards, including a number of codes approaching net zero.

UTILITIES AND INFRASTRUCTURE

A number of investor-owned utilities have also taken steps to reduce their reliance on fossil fuels. Duke Energy, one of the nation’s largest electricity producers, for example, committed to achieving net zero carbon emissions by 2050, joining more than three dozen other major utilities in establishing clean energy goals. These pledges demonstrate that power companies are beginning to shift their businesses towards low-carbon energy production.

Utilities are also embracing demand response programs to better manage short-term energy supply challenges by optimizing grid operations and resources. Demand response is a way to reduce the stress on the grid by incentivizing voluntary reductions or shifts in energy consumption. The avoided load for a single location may be small, but when many customers participate, it can result in a significant energy demand reduction for the utility.

NEW REQUIREMENTS OF CAPITAL SOURCES

Another factor influencing demand for high-performance buildings is the increasing stringency of requirements

from capital sources to reduce climate related-financial risk and better align borrowers with future carbon regulation. Many housing finance agencies (HFAs) providing low-cost capital to developers of multifamily affordable housing nationwide require that new construction and substantial rehabilitation projects meet some threshold of improved energy efficiency, and these standards are becoming increasingly more rigorous. For example, Enterprise Green Communities (EGC), a common standard for green affordable housing construction in the U.S., released new criteria in 2020 that aims for all-electric ready, climate-resilient, zero-emission affordable housing nationwide. Twenty-seven states and Washington, D.C. currently incentivize or require that affordable housing developments receiving public funds comply with the new criteria. For example, New York City’s Department of Housing Preservation and Development (HPD), the largest municipal housing agency in the nation, requires that all new construction and substantial rehabilitation projects receiving its funding comply with the New York City Overlay of the EGC certification criteria, which is adapted for New York City’s unique environment.

There is significant opportunity for energy efficiency improvements in the residential and commercial sectors, and the mortgage market has tremendous power to drive demand for low-carbon, resilient buildings which produce positive economic returns, reduce financial risk, and benefit the environment and communities. When lenders take energy efficiency into consideration, they tap into new markets and grow their portfolios, reduce the risk of default, deliver cost savings to owners and tenants, and help combat climate change and its impacts.

RISK MITIGATION

Risks Related to the Transition to a Low-Carbon Economy The Task Force on Climate-related Financial Disclosures (TCFD) recognizes climate change as a “systemic risk to the financial stability of the global economy.”

Financial institutions are facing increasing pressure over the link between climate-related risks and fiduciary duty. Likewise, investors are increasingly looking for investments that offer environmental and social impacts in addition to financial returns.

Carbon regulation has the potential to drive up the cost of fossil-fuel-based energy, and owners and lenders are exposed to these risks through their investments and loans. How the multifamily ecosystem quantifies the financial implications of climate-related risk will influence how quickly the industry adopts low-carbon solutions, and will require the multifamily ecosystem to reevaluate the way housing is constructed. Emerging carbon regulation could be the catalyst that shifts the market; as lenders and developers begin to account for climate-related risks in their project proformas, high-performance will become the new baseline.

There are operational steps lenders can take to incorporate the cost of carbon when making choices about capital investment and estimating costs throughout the investment’s lifecycle. The application of an internal carbon price (ICP) — a hypothetical price per ton of carbon — can serve as a tool to evaluate investment and lending opportunities by translating carbon risks into financial costs or savings.

Risks Related to the Physical Impacts of Climate Change

The physical risks of a changing climate are becoming prevalent. As average global temperatures rise, we will see an increase in the frequency and the severity of weather events such as hurricanes, forest fires, and floods, costing American tax-payers billions of dollars annually. The National Oceanic and Atmospheric Administration (NOAA) found that 2019 was the fifth consecutive year in which ten or more events costing $1 billion or more impacted the United States.10 In addition to destroying property and natural habitats, these events resulted in the deaths of hundreds of people and had significant local economic effects. Research shows that U.S. taxpayers save an average of $6 for every $1 the federal government spends on mitigation activities such as elevating homes and strengthening infrastructure.11 Nations are preparing for longer-term shifts in climate patterns that may cause sea level rise and chronic heat waves. Given the increasing frequency of natural disasters and the increasing cost of disaster recovery, resiliency and mitigation actions are critical for saving money, property, and, most importantly, lives.

UNITED STATES CLEAN ELECTRICITY COMMITMENTS AND CODES

CLEAN ENERGY GOALS

As of late 2019, fifteen states (and Washington, D.C. and Puerto Rico) have set official targets to source

at least 50 percent of their electricity from zero-carbon sources. These areas represent 28 percent of all U.S. electric power demand, up from 17 percent in 2018.

While the targets appear similar, the approaches to meeting them vary. Differences in market structures, existing energy infrastructure, access to new sources of renewable energy, and regulatory environments will determine the ways that states carry out their low-carbon transitions.

INTERNATIONAL ENERGY CONSERVATION CODE (IECC)

The IECC is referred to as America’s model energy code because building codes are state laws; there is no national building energy code. Regardless of when any state adopts a code, every three years, officials from municipalities across the country vote on proposed changes to the IECC to incorporate new building technologies and practices. This is done to ensure that new residential and commercial buildings meet modern-day minimum levels of safety and energy efficiency.

FINANCE AND BUILD

The importance of integrated design, metering, project timelines, and subsidy in financing high-performance affordable multifamily buildings.

INTEGRATED DESIGN – PLANNING AHEAD FOR GREATEST PERFORMANCE

The most important step toward achieving high-performance is bringing all parties involved in design and construction into an integrated design process. Garnering buy-in early on from the architect, engineers, general contractor, and their sub- contractors, will ensure proper installation of systems and envelope components, coordination with consultants and testing schedules, and will help streamline sequencing to limit disruptions to construction timelines. Architects, consultants, and engineers should be communicating and coordinating with the general contractor and sub-contractors, who will ultimately be responsible for properly installing essential components

of the HVAC systems and building envelope that will greatly impact the building’s performance. Early harmonization between these stakeholders will ensure an efficient installation and construction process.

This coordination should include clear direction on the following questions:

- Is the building being built to a certification standard?

- Has the team chosen a heating and cooling system?

- Will centralized or decentralized systems be used?

- How does this factor into metering configuration?

- Will utilities be directly metered or master metered and sub-billed to the tenants?

- Is heating and cooling ductwork separate from ventilation?

- Are ventilation rates specified?

- Are there window requirements?

- Has the architect detailed all thermally broken attachments?

- Has energy efficient common area lighting been included?

Accounting for these aspects of the project not only addresses existing conditions at the site but can guide how aggressively the projected performance can be underwritten. If the developer is not aiming to achieve

a specific certification, it is important for the lender to review any current ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) standards or similar modeling, as well as the owner’s projected costs. Lenders will need both projections to determine how the modeled consumption stacks up against current underwriting standards and what, if any, potential discounts will be placed on the modeled consumption and owner or energy consultant’s projected costs to determine how utilities will be calculated.

FINANCING AND THE FINANCIAL VALUE PROPOSITION

When look at a multifamily building through the lens of a lender, the building is broken down into component parts; in addition to units of housing, it becomes an asset made up of income and expense line items that must be vetted and assessed by the risk they pose.

INTEGRATING IMPROVED PERFORMANCE INTO THE FIRST MORTGAGE

Efficiency Increases Cash Flow

• Drawing from the Underwriting Efficiency Handbook, we know that one of the only practical ways to increase Net Operating Income (NOI) when rental income is capped by the market or rent regulations is to reduce expenses. Since many expenses are fixed, that leaves maintenance and operations costs as a lever to increase cash flow.13 (See the graphic below).

What are Maintenance and Operations (M&O) Standards?

• M&O Standards are used by lenders in project underwriting to estimate annual building operations and maintenance costs.

• M&O Standards are usually calculated based on

income and expense (I&E) reporting from properties in

a lender’s portfolio. A lender may replace certain line items if documentation (such as appraisals or utility bills) give a more accurate picture of a particular building’s performance.

Owner vs. Tenant Metering Considerations

- The utility expenses used in underwriting are based on the owner paid costs as the lender is primarily interested in the owner’s ability to repay the loan. There are three major adjustable costs that lenders consider when underwriting a deal: Heating, Electricity, and Water/ Sewer.

- The way these operating expenses are billed affects the calculation used to determine “savings” as a

way to increase NOI. If all expenses are paid by the owner, the lender can take all of the improved systems performance into account. If utilities are billed directly to the tenants, there are fewer opportunities for the owner to demonstrate where they will recapture their investment in improved performance. These considerations are important to understand as they affect property cash flow and, consequently, the amount of debt the project can take on.

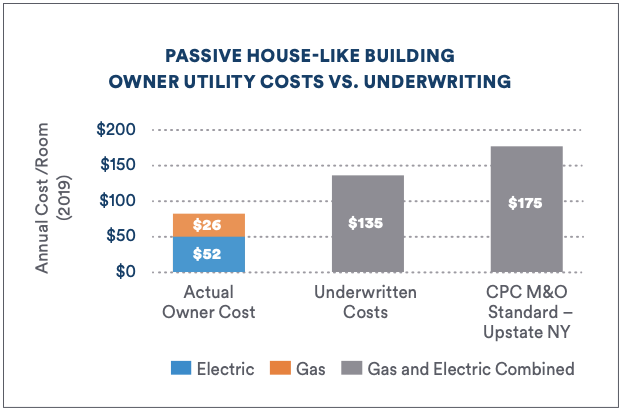

This CPC-financed building incorporated elements of Passive House design principles but ultimately did not certify. The high-performance design measures employed include:

- Thermally broken, highly insulated, airtight envelope

- Unitized natural gas-fired condensing boiler – Owner paid

- Rooftop solar PV array to offset owner-paid electricity

- NYSERDA Low-Rise New Construction (LRNC), NYSERDA Tier-3 Zero EPA v 3.1

‘

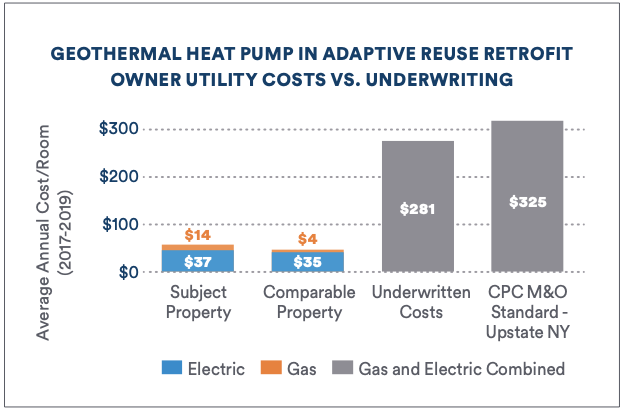

These two CPC-financed buildings drastically reduced owner-paid utility costs by employing geothermal heat pumps for centralized heating and cooling.

-

- Moderate insulation values on envelope; green-roof and rainwater harvesting

- Centralized heating and cooling geothermal heat pump – Owner paid

- Centralized heat recovery ventilator (HRV)

- NYSERDA Multifamily Performance Program (MPP), Enterprise Green Communities Certification

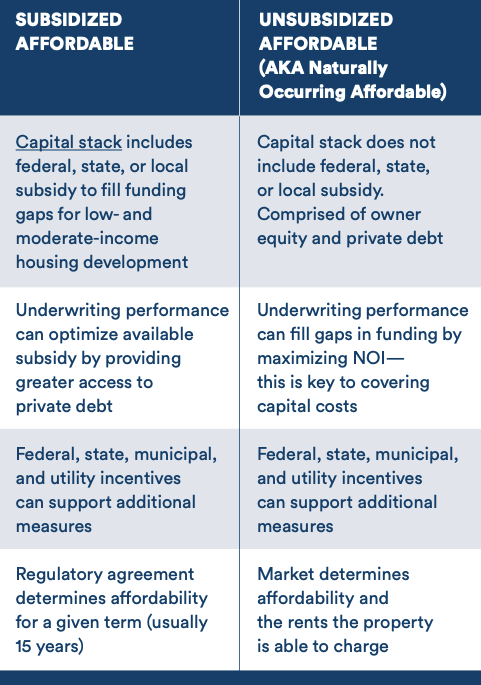

FINANCING AFFORDABLE HOUSING

Affordable multifamily buildings are limited in their ability to increase cash flow by increasing rents either because of a regulatory agreement requiring rents be below a certain threshold of area median income (AMI), or by the constraints of the market. Both serve populations that need quality housing at a stable cost. There are different considerations and resources available based on whether the project is affordable per a regulatory agreement with the municipality or state, or naturally occurring affordable based on local market factors.

FINANCING PATHWAYS

There are a few major pathways to explore when considering financing of high-performance systems:

• Equipment Loan – more typical in retrofits. This type of product can help pay for a large portion of a system upgrade or replacement but can carry a slightly higher cost of capital than longer-term debt.

• Construction Loan – this will cover the cost of construction – hard costs (ex. building materials, labor, systems, etc.) and soft costs (ex. architect and engineering fees, energy consultant, etc.)

• Permanent Loan – this will pay down the construction loan and secures a more favorable interest rate for the permanent mortgage.

• Refinance – this replaces the existing permanent mortgage debt and is often used to take advantage of a lower interest rate, to reduce monthly payments, and to tap into a property’s equity in order to access additional capital.

REDUCING COST TO BUILD

There are more and more examples of high-performance buildings being built at no additional cost beyond the developer’s standard budget. In their New York Getting to Zero Status Report (2019), the New York State Energy Research and Development Authority (NYSERDA) shares some of the best practices for minimizing the incremental costs associated with high-performance construction projects:

- Utilizing an integrated design process

- Working with an experienced design team

- Setting clear and measurable energy targets at the bid and contract stage

- Using lifecycle cost analysis and/or total cost-of- ownership to assess financial value

- Soliciting early feedback from team members to inform design

- Using all available rebates, incentives, tax credits, and green financing options

- Conducting iterative energy models to guide design decisions

- Involving maintenance staff, commissioning agents, and controls integrators throughout the design and construction process and during the first year of occupancy

- Minimizing value-engineering decisions late in the game that may disrupt energy performance

OPERATE AND MAINTAIN

Improved operations and maintenance through commissioning, monitoring, and engagement.

THE IMPORTANCE OF COMMISSIONING

Commissioning of new and existing buildings is an important mechanism for improving building energy performance. Commissioning is a process that ensures all systems and components are designed, installed, tested, and capable

of being operated and maintained as the project design intended. A third party provides a quality assurance evaluation of the design, construction, and operation of the building, creates a plan to verify all systems function efficiently throughout their operation, and ensures that the building staff is properly trained to operate the equipment.

Commissioning allows the building owner and property manager to identify performance issues during the design phase before they occur in operation, as well as after the building is constructed. Given the value add and cost savings associated with commissioning, many sustainability standards and codes now require commissioning, including LEED, ASHRAE 90.1, National Green Building Standard (NGBS), and Passive House Institute US (PHIUS).

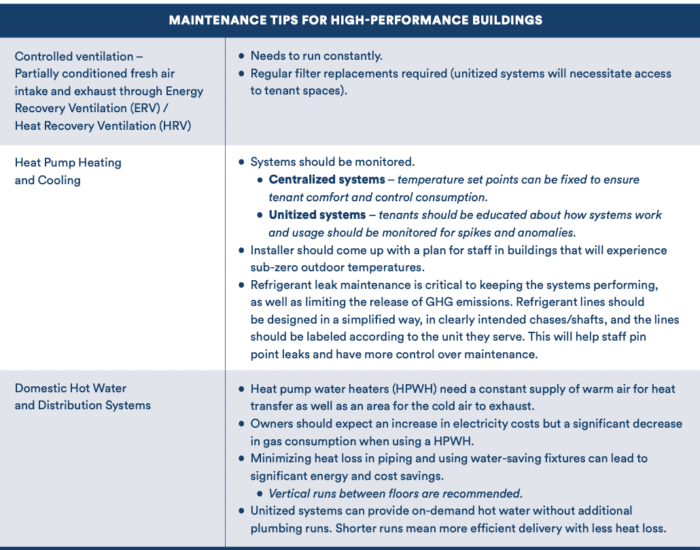

OPERATING A HIGH-PERFORMANCE BUILDING

Good operations and maintenance are essential to optimize efficiency for any type of building, and high-performance buildings are no different. However, newer or less common systems may mean building managers require additional training and support. When building managers are properly trained and able to maintain the systems, owners are able to avoid costly breakdowns during operation. In some cases, a service contract with the systems’ manufacturer may be the most effective way to ensure optimal performance and proper maintenance.

TENANT EDUCATION

Just as maintenance staff will likely need to be trained to properly operate and maintain the new systems, residents may also require education to ensure optimal performance of the newly adopted measures.

Encouraging building owners and staff to host training and educational events can ensure that resident actions align with the goals and projected outcomes of the project, and mitigate issues associated with system misuse.

Sample engagement measures include:

- Provide regular guidance on how to properly use apartment heating equipment

- Update the lease to authorize the collection

of resident utility data to support benchmarking - Residents may spot costly problems before maintenance staff does, so taking complaints seriously can help prevent incurring large unforeseen costs later

ASSET MANAGEMENT

Benchmarking Performance

Tracking performance through ongoing monitoring of utility usage and cost is the simplest method for verifying that projects are operating as intended, and to ensure utility expenses are in line with the underwritten costs. Utility benchmarking gives lenders, building owners,

and property managers insight into which systems are running inefficiently and how actual costs compare with projected costs.

Benchmarking is also a way for building owners to demonstrate long-term cost reduction that can be advantageous when looking to refinance the property. Likewise, this information can be used by lenders to inform future underwriting standards, how energy costs affect loan performance, and to guide policy decisions.

Systems Monitoring

It is important to monitor the building systems to improve operations, comfort, and asset value. There are many benefits of systems monitoring for property managers including energy and water savings and air quality control.

Multifamily buildings generate large amounts of data across HVAC, lighting, and other systems. Smart sensors (e,g., thermostats, lighting, and leak sensors), and connected building systems can make use of that data to predict maintenance needs and provide early detection of larger issues.

‘Smart buildings’ is a term often used to describe buildings that integrate technology, building systems, and people.

It is important to create a flexible platform which allows for future upgrades as building needs and technologies evolve.

APPRAISE AND RESELL

Finding comparables and evaluating owner projections to determine the added value of high-performance design and systems.

As cities and states across the U.S. work to transition to a low-carbon economy, high-performance buildings are becoming increasingly more valuable in the effort to reduce operational carbon emissions in the building sector. The industry’s familiarity with, and integration of, energy efficiency and points-based certification programs has demonstrated that these buildings carry a higher valuation than their code- built counterparts at appraisal and resale.

In a survey conducted by the National Association of Realtors (NAR), 69 percent of real estate agents stated that energy efficient promotions in listings were “somewhat” to “very valuable” in attracting interest. In a survey conducted by the World Green Building Council (WGBC), respondents reported that the top drivers for increasing demand for high-performance buildings are changing regulations and client interest.

Although there is abundant evidence that energy efficient buildings improve cash flow by lowering operating expenses, appraisers evaluating high-performance multifamily buildings still face challenges when asked to “prove the profit,” since they cannot point to indicators such as rent premiums — upcharges for building amenities or additional measures that add value for the tenant — as would be the case in market rate developments.

APPRAISAL 101

Multifamily buildings are typically appraised based on an income approach. The appraiser determines the fair market rent (FMR) of units based on size and comparable buildings (“comps”) and applies a Gross Rent Multiplier (GRM) for

the target market to assess the fair market value of the property.16 Comparable expenses play a part in assessing potential cash flow and the validity of owner projections.

ASSESSING ADDED VALUE: I&E VS. COMPS

One approach for interpreting the added value as a result of an additional dollar of energy savings is to recognize that expenses have a direct and equivalent effect on NOI, as reduced expenses improve cash flow. If we look strictly at reducing expenses and improving cash flow through energy efficiency and water conservation, based on a five percent capitalization rate,17 every dollar of increased NOI results in approximately $20 of additional value per unit.

This approach is not often reflected in appraisals due to the lack of comparable properties and understanding of how high-performance buildings impact total maintenance and operating costs.

IMPROVED PROPERTY CONDITION

How do we begin to incorporate the non-energy and expense-related benefits into our calculation?

Evidence for how improved tenant comfort, compliance with future climate regulation, and the potential for improved climate resiliency is still being examined and quantified. While the dataset for these comps is still growing, lenders and owners are working to bring these advantages to the forefront. In a recent report from Energy Efficiency for All (EEFA), Identifying, Valuing, and Financing Climate Resilience in Multifamily Affordable Housing (2020), “the cost effectiveness of pre-disaster resilience measures is becoming clearer…” The EEFA report goes on to highlight research completed by The National Institute of Building Sciences’ (NIBS) for their Natural Hazard Mitigation Saves (2019) report which examines the benefits of mitigation strategies beyond avoiding electric power interruptions.18 The NIBS report finds that “the nation [the U.S.] could save $11 in future disaster costs for every $1 spent on adopting model building codes that include climate resilience.”

NON-ENERGY BENEFITS OF HIGH-PERFORMANCE BUILDINGS

One hurdle to properly valuing the benefits of high-performance buildings is the incorporation of intangible and non-energy related benefits into the equation.

HEALTH BENEFITS

Americans spend 90 percent of their time indoors, making it important to understand how a building can affect the health of its occupants. High-performance buildings employ many design practices that collectively improve air quality and overall health of tenants. In a two-year study performed by Harvard University, researchers studying tenants of two “green” affordable multifamily buildings showed improvements in asthma and symptoms of sick building syndrome.20 (“Green” in this case refers to energy efficiency measures and the use of environmentally friendly materials).

A recent study performed by researchers at Mt. Sinai School of Medicine in New York City focused on the effects of living conditions and indoor air quality on tenant health in a conventional, code-built multifamily building compared to a multifamily building built to LEED Platinum standards. After moving into the LEED Platinum building for a period of 18 months, the study group showed decreases in daily respiratory symptoms and the number of asthma attacks that disrupted sleep and required emergency room visits.21

These studies, among others, have determined that buildings that prioritize energy efficiency and mechanical ventilation and use environmentally friendly materials, can have positive health outcomes for their tenants.

GREENHOUSE GAS REDUCTIONS

Measuring building system performance in terms of carbon emissions is critical to meeting ambitious carbon reduction goals and combating climate change. Emissions from the building sector (commercial and residential) in the U.S. account for 40 percent of the country’s total GHG emissions. While there have been improvements in building sector energy efficiency, as well as growth in the availability of clean, renewable energy, these have not significantly reduced the emissions from new construction. As a result, building sector CO2 emissions have continued to rise by nearly 1 percent per year since 2010.22

While many buildings employ some form of energy efficiency, high-performance buildings go much further. Super-insulated, air-tight construction with limited thermal bridging maintains indoor air temperature and limits loss of energy or conditioned air through the building envelope. This limits the load on HVAC systems so they can be sized for optimal performance. This more efficient use of heating and cooling systems results in significantly lower GHG emissions.

In combination with reducing energy consumption, a high-performance building can achieve net zero carbon emissions where the building’s operational emissions are 100 percent carbon-free. This can be achieved through all-electric systems reliant on a carbon-free electric grid, and/or through the purchase of carbon offsets.

RESILIENCY

Long-term resiliency is often sacrificed for short-term cost savings by building inefficiently. However, with the increasing frequency and destruction associated with natural disasters, the lifecycle building costs increase. As a result, policymakers are looking for ways to control costs by investing in mitigation activities — actions that reduce loss of life and property — before a disaster happens.

High-performance buildings with highly-insulated, airtight envelopes are better able to maintain building living conditions if HVAC systems are offline. Buildings with high- performance envelope designs are naturally more resilient to major weather events including hurricanes and extreme heat than conventional buildings.

High-performance buildings also maintain indoor temperatures longer than conventionally built buildings, keeping tenants safe in the event of a power outage. Some essential systems can be run on back-up generators or solar storage units using a smart inverter to convert solar power to energy when the grid is offline.

If a high-performance building makes use of on-site renewable energy, that energy can be used in the event of a wider power outage and gives the building a reliability advantage. Following the devastation of Hurricane Sandy in 2012, which caused nearly $70 billion of damage, many states along the Atlantic seaboard identified resiliency as a policy priority.

It is becoming increasingly important for every actor within the multifamily ecosystem to understand how different systems impact asset value. Appraisers may need specialized training to help them accurately assess the value of a building that requires dramatically less energy to operate, or a home that generates all of the energy it utilizes. Likewise, buildings that are all-electric or built to net zero energy standards will be less affected by future carbon regulation which could negatively impact cash flow as a result of fines and penalties. When evaluating a building, the reduced compliance cost must be factored into the overall valuation of the building.

It is also imperative that billing and energy use data from high-performance buildings becomes more readily available and accessible. This data helps appraisers and others in the multifamily ecosystem understand how comparable buildings have performed historically to make informed decisions about how high-performance systems and long-term reductions in utility costs, commissioning costs, and, potentially, in climate risk translate into value. As these projects increase in numbers, communication between different actors in the multifamily ecosystem remains essential to support the growth of the market for high-performance buildings.

BUILDING FOR THE FUTURE

Designing for today’s codes and standards with tomorrow’s technology and regulations in mind.

A number of factors contribute to the market reaching for stricter, more efficient design standards. Urgency is growing across the country as communities experience the impacts of climate change on their environment, health, and economy.

INCREMENTAL COSTS ARE DECREASING

As cities and states adopt increasingly rigorous energy codes and expand requirements for construction quality control, the incremental cost to build to high-performance standards is beginning to come down. This is creating greater demand for these types of buildings and more readily available performance data to help guide M&O standards for underwriting, and more accurate appraisals. As incremental costs come down, this will remove the need for additional up-front capital and therefore less debt. As a result, the economic benefits of energy savings will flow to the owner as profit rather than to the lender to pay the debt associated with the higher capital costs.

THE COST OF CARBON IS INCREASING

Meanwhile, new policy and regulatory changes aimed at reducing GHG emissions are advancing. Carbon regulation has the potential to drive up the cost of fossil- fuel-based energy, increasing operating costs and reducing profit margins. This will increase the demand for low-carbon alternatives and drive sustainable economic activity and investment towards low-carbon innovation. The construction and energy efficiency sectors are in active discussions on accounting for the embodied carbon in construction processes, and a handful of states and regions are instituting their own forms of carbon pricing (example from NYC’s Local Law 97 ). It is important for the multifamily ecosystem to understand how carbon regulation could affect their business practices so that the system as a whole is better equipped to manage those changes when they occur.

ALL-ELECTRIC AND ELECTRIC-READY BUILDINGS

Addressing the energy consumed by buildings is critical to achieving our carbon reduction goals. A cleaner grid has already led to reductions in emissions, and this trend is expected to continue as more states require utilities to produce all of their electricity from zero-carbon sources. New York, for example, now requires that 70 percent of electricity come from renewable sources by 2030.

Urban Green Council’s Going Electric report (2020) highlights the fact that the transition to a low-carbon future also depends on changes we make to the way we heat and cool our buildings. Improving energy efficiency will get us a part of the way there but to achieve meaningful reductions, we will need to transition from burning oil and gas to using affordable, renewable electricity. This will mean replacing boilers and furnaces with high-efficiency heating systems that run on renewable electricity, such as heat pumps. In addition to being a low-carbon heating and cooling solution, and providing greater access to cooling in a warming climate, replacing oil and gas boilers with heat pumps provides better indoor and outdoor air quality.

In order to stay ahead of the curve, it is important to start adapting practices today. A high-performance building that is all-electric or electric-ready with on-site renewable generation will be best prepared to adapt to changing regulations and clean energy infrastructure. These buildings will be best suited to take advantage of the deployment of low-carbon equipment and appliances, making the initial investment more valuable in the long-run. Building to high- performance standards today means preparing for tomorrow.

LOCAL LAW 97 – CARBON PENALTIES AND HIGH-PERFORMANCE BUILDINGS

In 2019, New York City (NYC) passed the Climate Mobilization Act, a suite of legislation aimed at reducing GHG emissions from the City’s building stock.23 Local Law 97 (LL97), the cornerstone of the new legislation, places limits on carbon emissions related to energy use beginning in 2024 and becoming more stringent over time for buildings greater than 25,000 square feet. Each metric ton of carbon dioxide equivalent (tCO2e) emitted over the building’s established cap will be fined $268. While some of the building stock is currently exempt, building owners and lenders are proactively evaluating how the new regulation will affect them and what they can do to mitigate financial risk to their portfolios.

Given the superior energy efficiency of high-performance buildings, the operational carbon emissions can be significantly lower than those of a conventional building constructed to less stringent performance standards. This means that high-performance buildings are less likely to face high fines as a result of future regulation, or may avoid them altogether.

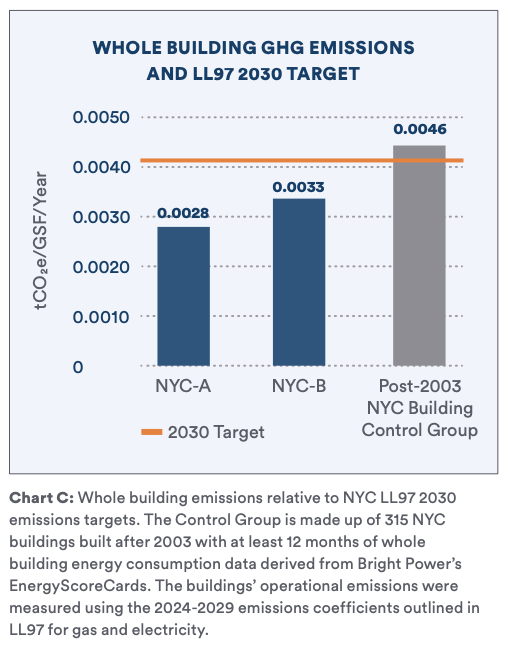

Chart C shows the GHG emissions profile for two uncertified Passive House multifamily buildings in NYC, both with gas-fired heating and hot water, as well as a control group made up of buildings constructed after 2003 of which 94 percent have gas heating and 6 percent have electric heating. As the chart shows, both of these high-performance projects would easily comply with

Chart C shows the GHG emissions profile for two uncertified Passive House multifamily buildings in NYC, both with gas-fired heating and hot water, as well as a control group made up of buildings constructed after 2003 of which 94 percent have gas heating and 6 percent have electric heating. As the chart shows, both of these high-performance projects would easily comply with

the 2030 emissions cap. This means these buildings do not need to invest in measures to reduce their GHG emissions in order to comply with LL97 2030 targets; compliance is built in based on their energy efficient, low-carbon design.

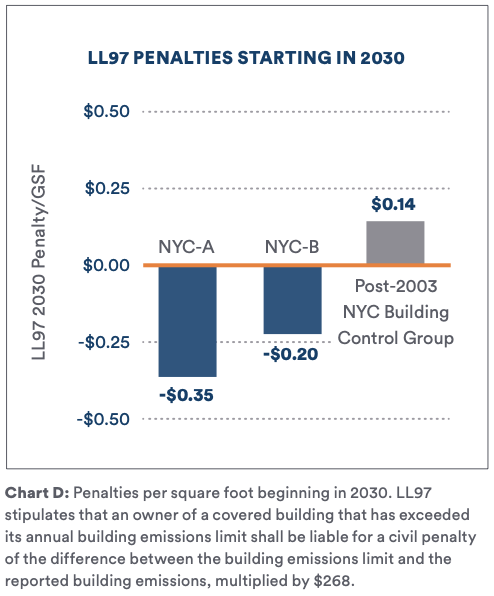

Chart D shows the LL97 penalties per square foot based on the 2030 target. Translating these GHG savings into avoided penalties helps illustrate the reduced financial risk high-performance buildings face as a result of carbon regulation.

Chart D shows the LL97 penalties per square foot based on the 2030 target. Translating these GHG savings into avoided penalties helps illustrate the reduced financial risk high-performance buildings face as a result of carbon regulation.

If Carbon Trading is introduced, there may

be an opportunity for high-performance buildings to capitalize on their carbon savings.

• NYC-A: +$9,112 per year

• NYC-B: +$4,640 per year

• Control Group: penalty of $7,000 per year

Total based on the buildings’ total gross square footage and the LL97 penalty of $268/ton of CO2e.

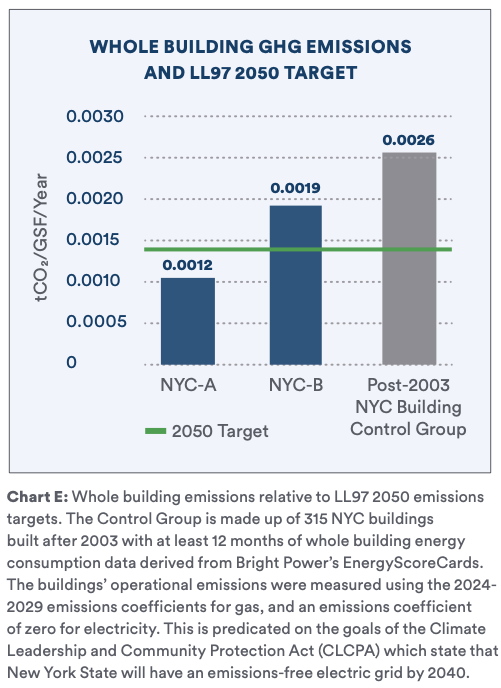

As Chart E shows, even when evaluated against the ambitious target set for 2050, projects that utilize high- performance design principles are closer to complying with the strict 2050 cap. If these projects had pursued all-electric systems for their heating and hot water needs, both would have emissions below the 2050 caps.

As the results illustrate, buildings built to a high- performance standard are in a much better position to handle pending carbon regulation. The choice to install gas- fired systems in the two example buildings limits the ability to reduce operational emissions. However, the inclusion of other high-performance design elements (e.g., continuous insulation, airtightness) keeps these buildings in compliance for a longer period than the post-2003 building stock.